By 2025, over 70% of financial institutions are expected to rely on A.I. to drive mission-critical decisions and operations. For today’s finance leaders, this isn’t just a trend—it’s a transformative opportunity.

A.I. goes beyond automating routine tasks; it unlocks deep insights that empower smarter decision-making and fuel sustainable growth. In an era of rapid change, embracing A.I. isn’t optional—it’s essential to maintain your competitive edge and future-proof your organization.

Discover how A.I. is reshaping the finance sector, tackling challenges, and enabling leaders like you to drive strategic innovation.

Plus, access our free roadmap to seamlessly integrate A.I. into your finance operations, accelerating adoption and maximizing ROI.

The future of finance is here. Take the lead in shaping it.

- The Growing Role of A.I. in Finance

- The Perception of Accounting and Finance is Changing in an A.I.-Driven World

- A.I. Integration Needs a Strategic Approach to Ensure Return on Investment (ROI)

- Navigating the Challenges of A.I. in Finance

- Responsible A.I.: Ethics and Governance

- Key Components of a Responsible A.I. Framework

KEY TAKEAWAYS

- Integrating A.I. is crucial for maintaining a competitive edge, gaining valuable insights, and automating routine financial tasks.

- CFOs can overcome the challenge of understanding A.I. by upskilling finance teams and investing in educational resources.

- Ethical concerns can be addressed with a robust A.I. governance framework to ensure compliance and minimize risks like data privacy issues and bias.

- The impact of A.I. on the workforce can be mitigated through strategic reskilling initiatives and transparent communication.

- Establishing a strong framework for responsible A.I. is essential to maintain trust across the organization and with stakeholders.

The Growing Role of A.I. in Finance

A.I.'s potential in finance is vast, from automating routine tasks to providing sophisticated analytical insights that inform strategic decisions. However, the integration of A.I. brings its own set of challenges and opportunities.

According to Susie Duong, Senior Director of Research and Thought Leadership at the Institute of Management Accountants (IMA), CFOs and accounting leaders must critically assess how A.I. will impact their teams and the services they provide to customers.

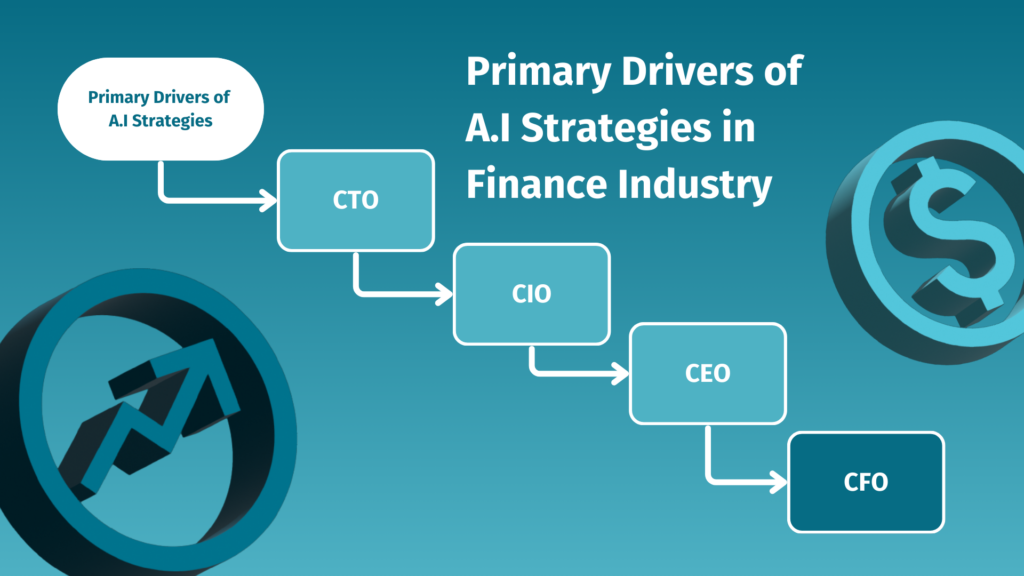

Despite not being the primary drivers of A.I. strategies in their organizations—typically trailing behind CTOs, CIOs, and CEOs—CFOs play a crucial role in how A.I. is adopted and utilized within their departments.

A study by Gartner revealed that CFOs are often critical of the performance of digital investments, highlighting the importance of a well-thought-out A.I. strategy that justifies its costs through clear returns on investment or strategic benefits.

The Perception of Accounting and Finance is Changing in an A.I.-Driven World

To illustrate the importance of strategic foresight, Duong stressed the evolving role of CFOs and the need to consider changing perceptions as A.I. becomes more commonplace in the finance and accounting sector. She highlighted that today's college students, who are already learning how to use A.I., will have a completely different perception of accounting and finance when they enter the profession.

For this reason, CFOs can't afford to be complacent when it comes to A.I. education and must ensure the company and its talent are keeping pace with the rapid evolution of technology.

As A.I. continues to advance, CFOs must take proactive steps to integrate this technology into their operations and strategy. This involves not only understanding A.I. but also preparing their teams for a future where A.I. is a ubiquitous part of the finance landscape.

In doing so, they can ensure that their organizations not only survive—but thrive—in this new era of digital finance.

A.I. Integration Needs a Strategic Approach to Ensure Return on Investment (ROI)

Integrating A.I. into financial operations requires a strategic approach to ensure a meaningful return on investment (ROI). Given the significant opportunity costs associated with A.I. implementation, finance leaders must craft a forward-thinking strategy to justify these investments.

"As A.I. continues to advance, CFOs must take proactive steps to integrate this technology into their operations and strategy... they can ensure that their organizations not only survive—but thrive—in this new era of digital finance."

As Duong points out, "Implementing A.I. is expensive; when businesses decide to incorporate it, they must forgo other potential initiatives. This represents the opportunity cost."

To navigate these challenges effectively, CFOs should engage team members at all levels, clearly communicating the benefits of A.I. integration for both the organization and individual roles. Moreover, offering opportunities for upskilling and reskilling is crucial to help employees adapt to the evolving A.I.-driven work environment.

Navigating the Challenges of A.I. in Finance

Implementing A.I. in finance is not without its challenges. In fact, there are four key areas where CFOs often face hurdles:

1. Understanding the Technology

Many finance professionals are not trained in the technical aspects of A.I., making it crucial for them to educate themselves about how these technologies work.

2. Ethics and Governance

As A.I. becomes more prevalent, issues of ethics in A.I. deployment, such as data privacy and bias, become increasingly important.

3. Operational Issues

Integrating A.I. into existing systems and workflows can be complex and requires careful planning.

4. The Human Element

Perhaps the most significant challenge is managing the impact of A.I. in the workforce. A.I.'s automation capabilities may create anxiety around workforce roles, but strategic upskilling mitigates these concerns

Responsible A.I.: Ethics and Governance

Strong A.I. governance is essential to mitigate risks and ensure compliance with evolving regulations. Financial institutions must establish frameworks to align A.I. development with their values and ethical principles.

This approach, known as ethical A.I., ensures transformative business impact while maintaining trust and acceptance within the organization.

"Strong A.I. governance is essential to mitigate risks and ensure compliance with evolving regulations. Financial institutions must establish frameworks to align A.I. development with their values and ethical principles."

Key Components of a Responsible A.I. Framework

- Strategy: A comprehensive A.I. strategy linked to the firm's values, risk strategy, and ethical principles.

- Governance: Oversight by a defined responsible A.I. leadership team with established escalation paths to identify and mitigate risks.

- Processes: Rigorous processes to monitor and review products to ensure they meet responsible A.I. criteria.

- Technology: Data and technology infrastructure to mitigate A.I. risks, including toolkits for responsible A.I. by design and appropriate life-cycle monitoring.

- Culture: A strong understanding among all staff and users of their roles and duties in upholding responsible A.I.

"By integrating A.I., you’re not just automating routine tasks—you’re gaining valuable insights that inform strategic decisions and drive your organization forward."

In conclusion, the integration of artificial intelligence in finance is not just a trend; it’s a pivotal shift that can redefine how organizations operate and compete. By embracing A.I., finance leaders can unlock transformative insights that enhance decision-making and drive sustainable growth.

However, this journey requires a strategic mindset, a commitment to ethical governance, and a focus on upskilling teams to adapt to new technologies.

As you navigate the complexities of A.I. integration, remember that proactive engagement and clear communication will be key to fostering a culture that embraces innovation.

Navigate the A.I. Revolution: Download Our A.I. Translation Adoption Roadmap Infographic for Finance Teams

Equip your finance team with a step-by-step roadmap to A.I. integration.

Download our free infographic now and lead your company into the future of finance.