The financial landscape in 2025 is not just evolving—it's undergoing a seismic shift that will redefine how we perceive money and banking forever. As technology and consumer behaviours converge, the traditional financial paradigms are being challenged like never before.

Are you ready to explore the forces driving this transformation and understand how they can redefine your financial strategies? Here are the top five financial trends to watch for 2025.

KEY TAKEAWAYS

- A.I. and machine learning are driving efficiency and innovation in the financial sector.

- Digital-only banking and fintech innovations are reshaping financial services, emphasizing convenience and personalized experiences.

- Regulation technology (RegTech) is enhancing compliance efficiency and data protection.

- The Buy Now, Pay Later (BNPL) sector is expanding, fueled by consumer demand and technological advances.

1. A.I. and Machine Learning

A.I. continues to revolutionize the financial sector, with 2024 seeing even greater adoption across various applications. Recent statistics indicate a significant increase in A.I.-driven solutions for automated trading, fraud detection, and personalized financial advice.

The evolution of A.I. technologies, such as generative A.I., are enhancing data analysis capabilities, allowing financial institutions to offer more precise and efficient services.

A.I. Applications in Finance

A.I. applications in finance are diverse and expanding rapidly. In 2024, we’ve seen several key areas where A.I. is making a substantial impact:

- Automated Trading Systems: A.I. algorithms are increasingly used to analyze market data and execute trades at optimal times. These systems leverage machine learning to identify patterns and predict market movements, offering traders a competitive edge.

- Fraud Detection and Prevention: Financial institutions are utilizing A.I. to enhance their fraud detection capabilities. A.I. systems can analyze vast amounts of transaction data in real-time, identifying anomalies and potential fraudulent activities more accurately than traditional methods.

- Customer Service and Personalization: A.I.-powered chatbots and virtual assistants are improving customer service by providing instant responses to inquiries and personalized financial advice. These tools help banks and financial services tailor their offerings to individual customer needs, enhancing user satisfaction.

- Credit Scoring and Risk Management: A.I. is transforming credit scoring by incorporating alternative data sources and advanced analytics. This allows for more accurate assessments of creditworthiness and risk, enabling lenders to make better-informed decisions.

These applications demonstrate A.I.'s potential to enhance efficiency, reduce costs, and improve decision-making processes in the financial industry.

As A.I. technology continues to advance, its role in finance is expected to grow even further, driving innovation and transformation across the sector. According to a report by MarketsandMarkets, A.I. in the financial market is expected to grow to $26.67 billion by 2025.

DID YOU KNOW?

A.I. in the financial market is expected to grow to $26.67 billion by 2025.

Source: MarketsandMarkets

2. Digital-Only Banking and Fintech Innovations

The digital banking sector is witnessing the entry of new players, further intensifying competition. In 2025, digital-only banks are expected to expand their offerings, focusing on personalized customer experiences and innovative financial products.

Post-pandemic consumer behaviour trends show a strong preference for digital solutions, with an emphasis on convenience and accessibility. Emerging fintech startups continue to disrupt traditional banking models, offering competitive interest rates and unique features.

Emerging Financial Trends in Digital Banking

Digital-only banking and fintech innovations are reshaping the financial landscape, offering a range of benefits and new opportunities:

- Enhanced Customer Experience: Digital-only banks, often referred to as neobanks, provide a seamless and personalized banking experience. They leverage A.I. and data analytics to offer tailored financial advice, real-time transaction alerts, and budgeting tools, enhancing customer satisfaction and engagement.

- Cost Efficiency and Accessibility: Without the overhead of physical branches, digital-only banks can offer lower fees and more competitive rates. This cost efficiency allows them to invest in technology and improve their digital platforms, making banking more accessible to a broader audience.

- Innovative Financial Products: Fintech innovations are driving the development of new financial products and services. From mobile payment solutions to peer-to-peer lending platforms, these innovations are providing consumers with more choices and flexibility in managing their finances.

- Security and Trust: Digital banks are implementing advanced security measures, such as biometric authentication and encryption, to protect customer data and transactions. This focus on security helps build trust with consumers who are increasingly concerned about digital privacy.

- Regulatory Challenges and Opportunities: As fintech continues to grow, regulatory frameworks are evolving to ensure consumer protection and market stability. Digital-only banks must navigate these regulations while continuing to innovate and differentiate themselves in a competitive market.

These trends highlight the transformative impact of digital-only banking and fintech innovations on the financial industry.

As technology continues to advance, these institutions are well-positioned to meet the evolving needs of modern consumers, offering convenience, efficiency, and personalized services.

A recent survey by Deloitte found that 71% of consumers prefer to manage their bank accounts through a mobile app or a computer.

"Post-pandemic consumer behaviour trends show a strong preference for digital solutions, with an emphasis on convenience and accessibility. Emerging fintech startups continue to disrupt traditional banking models, offering competitive interest rates and unique features."

3. Software as a Service (SaaS) in Finance

SaaS solutions are becoming increasingly vital in the financial industry, offering scalability, flexibility, and cost-effectiveness. In 2025, the adoption of SaaS in finance is expected to continue to grow significantly as financial institutions seek to modernize their operations and enhance their service offerings.

SaaS platforms provide cloud-based services that eliminate the need for extensive hardware investments and maintenance, allowing businesses to focus on innovation and customer satisfaction.

Key SaaS Applications in Finance

SaaS in finance encompasses a variety of applications that are transforming how financial services are delivered and managed:

- Financial Management and Accounting: SaaS platforms like QuickBooks Online and Xero provide comprehensive tools for managing finances, including expense tracking, invoicing, and financial reporting. These solutions offer real-time data access and integration with other business systems, enhancing financial transparency and decision-making.

- Customer Relationship Management (CRM): Financial institutions are leveraging SaaS CRM solutions to improve customer engagement and retention. These platforms facilitate personalized communication, track customer interactions, and provide insights into customer behaviour, enabling more targeted marketing strategies.

- Regulatory Compliance and Risk Management: SaaS solutions help financial institutions navigate complex regulatory environments by automating compliance processes and providing robust risk management tools. This reduces the burden of manual compliance checks and enhances the ability to respond to regulatory changes quickly.

- Investment and Trading Platforms: SaaS-based trading platforms offer users access to financial markets with advanced analytics and automated trading capabilities. These platforms are particularly beneficial for small and medium-sized enterprises (SMEs) and individual investors seeking cost-effective trading solutions.

- Cybersecurity and Data Protection: With the increasing threat of cyberattacks, SaaS providers are prioritizing security features such as encryption, multi-factor authentication, and continuous monitoring. This ensures that financial data is protected and complies with industry standards.

These applications demonstrate the transformative potential of SaaS in finance, enabling institutions to operate more efficiently, reduce costs, and deliver enhanced services to their customers.

DID YOU KNOW?

The financial SaaS market is projected to reach a valuation of $247.2 billion by the end of 2024.

Source: Statista

As the financial landscape continues to evolve, SaaS solutions will play a crucial role in driving innovation and maintaining competitive advantage. The SaaS market is projected to reach a valuation of $247.2 billion by the end of 2024, according to a report by Statista.

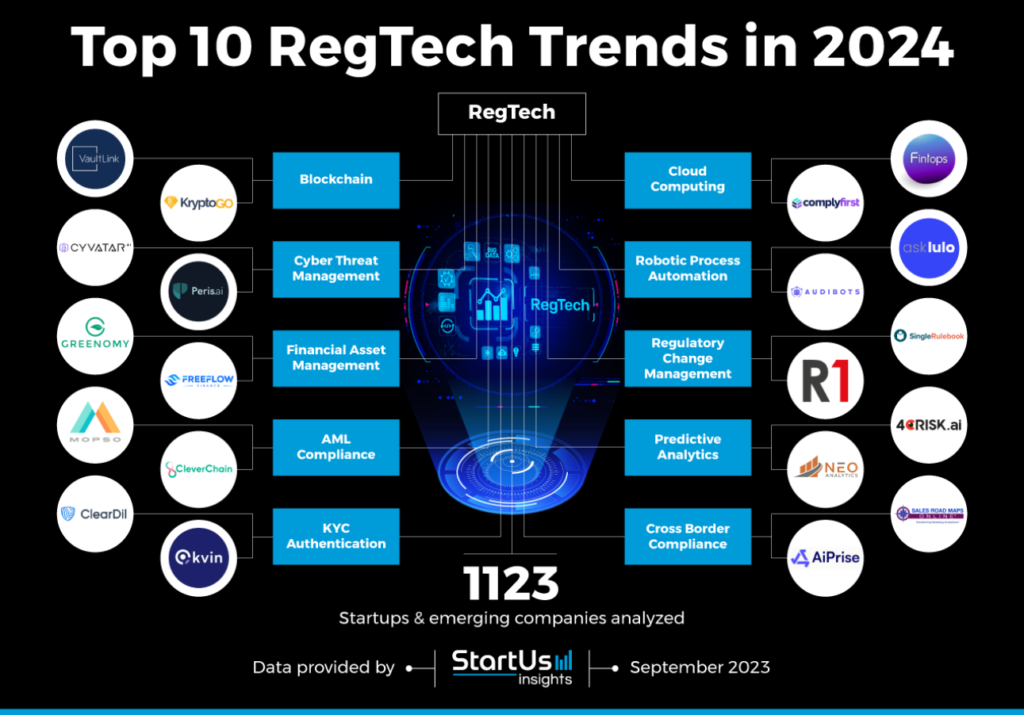

4. RegTech and Compliance Management

Regulation Technology (RegTech) continues to gain traction as financial institutions navigate complex regulatory landscapes. In 2024, new regulations introduced in various regions necessitate efficient compliance solutions.

RegTech innovations are helping organizations automate compliance processes, reduce costs, and mitigate risks associated with non-compliance. The focus is on integrating A.I. and machine learning to improve regulatory reporting and enhance transparency.

Innovations in Compliance Management

RegTech is revolutionizing compliance management in the financial sector by offering innovative solutions that streamline regulatory processes:

- Automated Reporting and Monitoring: RegTech solutions leverage A.I. to automate the collection and analysis of regulatory data. This reduces the time and resources required for compliance reporting and ensures accuracy and consistency in meeting regulatory requirements.

- Risk Assessment and Management: Advanced analytics and machine learning algorithms are used to identify and assess potential compliance risks. These tools enable financial institutions to proactively manage risks and implement effective mitigation strategies, reducing the likelihood of regulatory breaches.

- Identity Verification and KYC: RegTech platforms enhance Know Your Customer (KYC) processes by automating identity verification and due diligence checks. This not only speeds up customer onboarding but also improves the accuracy and reliability of customer data, ensuring compliance with anti-money laundering (AML) regulations.

- Regulatory Change Management: With regulations constantly evolving, RegTech solutions provide real-time updates and insights into regulatory changes. This helps financial institutions stay informed and adapt their compliance strategies accordingly, minimizing the risk of non-compliance.

- Data Privacy and Protection: RegTech tools ensure that financial institutions comply with data protection regulations, such as GDPR, by implementing robust data governance frameworks. These solutions help manage data privacy risks and maintain customer trust.

By adopting RegTech solutions, financial institutions can enhance their compliance capabilities, reduce operational costs, and improve their ability to respond to regulatory changes.

Source: StartUs Insights

As regulatory demands continue to grow, RegTech will play an increasingly vital role in ensuring financial institutions remain compliant and competitive. According to a report by Allied Market Research, the global RegTech market is expected to grow at a compound annual growth rate (CAGR) of 22.6% from 2023 to 2032.

5. Buy Now, Pay Later (BNPL) Services

BNPL services continue to gain popularity, with 2025 expected to see further increases in consumer adoption alongside heightened regulatory scrutiny, following the trends observed in 2024. Recent data shows a rise in BNPL usage, driven by consumer demand for flexible payment options.

However, new regulations are being implemented to ensure consumer protection and responsible lending practices. Financial institutions and retailers are adapting to these changes, offering more transparent and secure BNPL solutions.

Trends in BNPL Services

The BNPL sector is evolving rapidly, with several key applications and trends shaping its future:

- Consumer Adoption and Market Growth: The BNPL market is projected to grow significantly, with its value expected to increase from $156.58 billion in 2023 to $232.23 billion in 2024. This growth is fueled by the rise of online shopping and the demand for flexible payment solutions, particularly among Millennials and Gen Z.

- Regulatory Developments: In 2024, regulatory bodies like the Consumer Financial Protection Bureau (CFPB) in the U.S. and the Financial Conduct Authority (FCA) in the UK have introduced new rules to oversee BNPL providers. These regulations aim to enhance transparency, consumer protection, and responsible lending. The increased regulatory oversight is expected to boost consumer confidence and encourage more widespread adoption of BNPL services.

- Technological Advancements: BNPL providers are leveraging technologies such as A.I. and machine learning (ML) to improve credit assessments and fraud detection. These technologies help in accurately assessing consumer creditworthiness and reducing the risk of defaults, ensuring safer transactions for both consumers and merchants.

- Integration with eCommerce and Retail: BNPL services are increasingly integrated with eCommerce platforms and physical retail, enhancing the shopping experience by offering personalized payment plans and rewards. This integration not only boosts sales for retailers but also provides consumers with more convenient and tailored financing options.

- Consumer Education and Financial Literacy: To promote responsible borrowing, BNPL providers are focusing on educating consumers about the implications of using these services. This includes offering financial literacy programs and ensuring transparent communication about fees and repayment terms.

Source: DemandSage

These trends highlight the dynamic nature of the BNPL market and its potential to reshape consumer finance.

As BNPL services continue to evolve, they offer both opportunities and challenges for consumers, retailers, and financial institutions alike.

Conclusion

As we continue to navigate the remainder of 2024, these financial trends highlight the transformative impact of technology and regulation on the industry.

By understanding and adapting to these changes, businesses and investors alike can position themselves for success in an ever-evolving financial landscape.

Stay informed and leverage these insights to make informed decisions and capitalize on emerging opportunities to propel your business forward.

Stay Ahead of the Curve in 2025—and Beyond!

Don’t miss out on the knowledge that can help you stay competitive in 2025. Subscribe to our newsletter for exclusive insights into the latest financial trends, expert analysis, and more. Be the first to know—sign up today!